| IPO Update: Hanryu Holdings Seeks $36 Million U.S. IPO (HRYU) | 您所在的位置:网站首页 › pass holding › IPO Update: Hanryu Holdings Seeks $36 Million U.S. IPO (HRYU) |

IPO Update: Hanryu Holdings Seeks $36 Million U.S. IPO (HRYU)

|

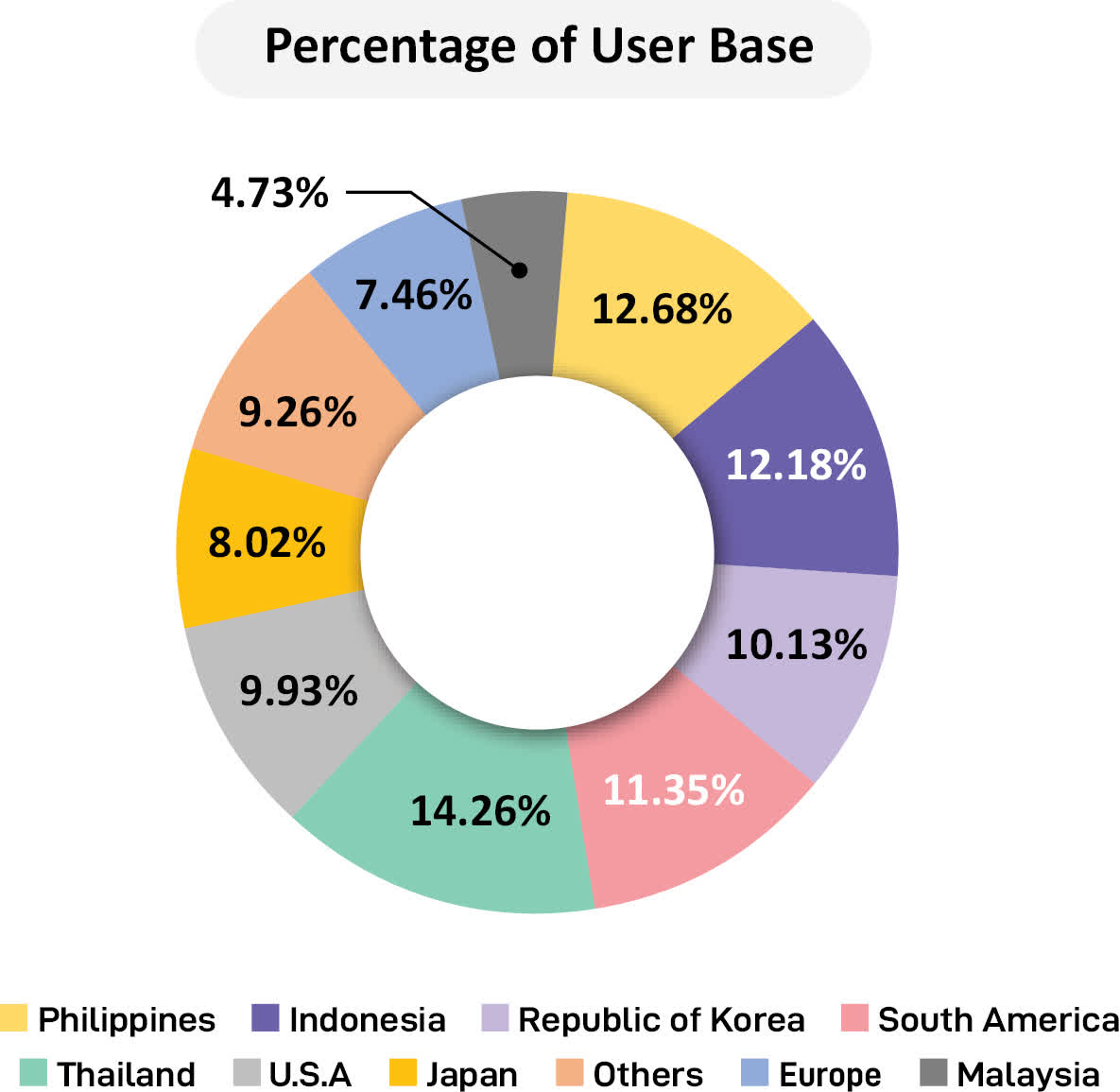

Robert Daly/OJO Images via Getty Images A Quick Take On Hanryu HoldingsHanryu Holdings (HRYU) has filed proposed terms to raise $36.4 million in gross proceeds from the sale of its common stock in an IPO, according to an amended registration statement. The firm operates a fan-enabled platform primarily for the Asian entertainment industry. HRYU is still a very small company with little operating history and presents a variety of risks. Given the firm's tiny revenue base and excessive valuation assumptions, I'll pass on the IPO. Hanryu OverviewSeoul, Republic of Korea-based Hanryu Holdings, Inc. was founded to create a fan-oriented online platform to provide culture and entertainment services. Management is headed by Chief Executive Officer Mr. Chang-Hyuk Kang, who has been with the firm since 2021 and has an extensive financial and tax employment background. The company's primary offerings include FANTOO, which is a platform that enables the creation of online fan spaces and economic rewards in return for user contributions. The online fan engagement platform industry is used by celebrities and fandom communities to engage with each other and monetize their fan base. As of Sept. 30, 2022, Hanryu has booked a fair market value investment of $26.3 million from investors including Paxnet Co. and various individuals. Hanryu - User AcquisitionThe firm markets its social media mobile app via major app platforms and through online media and social media activities. Since the FANTOO site's launch in Mary 2021, it has attracted over 18.9 million users, with the user base percentages from various regions shown below:

User Base By Location (SEC) Marketing and Advertising expenses as a percentage of total revenue have dropped as revenues have increased, as the figures below indicate: Sales & Marketing Expenses vs. Revenue Period Percentage Year Ended Dec. 31, 2022 37.0% Year Ended Dec. 31, 2021 113.0% (Source - SEC) The Marketing and Advertising efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Marketing and Advertising spend, fell to 1.2x in the most recent reporting period. (Source - SEC) Hanryu's Market and CompetitionAccording to a 2021 market research article by Financial Express, the global market for celebrity-fan engagement is an estimated $10 billion business. There's significant variation in fan engagement site features and business models. Also, the rise in the use of NFTs, or Non-Fungible Tokens, also presents the industry with further business model options. Major competitive or other industry participants include: Lysn Weverse Universe Whattpad Amazon eBay Ticketmaster Hanryu Holdings' Financial PerformanceThe company's recent financial results can be summarized as follows: Growing topline revenue from a tiny base A swing to gross profit and positive gross margin Reduced operating losses Lowered cash used in operations Below are relevant financial results derived from the firm's registration statement: Total Revenue Period Total Revenue % Variance vs. Prior Year Ended Dec. 31, 2022 $ 889,045 85.1% Year Ended Dec. 31, 2021 $ 480,224 Gross Profit (Loss) Period Gross Profit (Loss) % Variance vs. Prior Year Ended Dec. 31, 2022 $ 433,266 -647.1% Year Ended Dec. 31, 2021 $ (79,195) Gross Margin Period Gross Margin % Variance vs. Prior Year Ended Dec. 31, 2022 48.73% -395.5% Year Ended Dec. 31, 2021 -16.49% Operating Profit (Loss) Period Operating Profit (Loss) Operating Margin Year Ended Dec. 31, 2022 $ (6,603,325) -742.7% Year Ended Dec. 31, 2021 $ (20,453,973) -4259.3% Net Income (Loss) Period Net Income (Loss) Net Margin Year Ended Dec. 31, 2022 $ (6,386,503) -718.4% Year Ended Dec. 31, 2021 $ (12,764,662) -1435.8% Cash Flow From Operations Period Cash Flow From Operations Year Ended Dec. 31, 2022 $ (4,096,948) Year Ended Dec. 31, 2021 $ (7,814,399) (Glossary Of Terms) (Source - SEC) As of December 31, 2022, Hanryu had $118,957 in cash and $7.4 million in total liabilities. Free cash flow during the twelve months ended Dec. 31, 2022, was negative ($4.1 million). Hanryu's IPO DetailsHRYU intends to sell approximately 3.6 million shares of common stock at a proposed midpoint price of $10.00 per share for gross proceeds of approximately $36.4 million, not including the sale of customary underwriter options. No existing or potentially new shareholders have indicated an interest in purchasing shares at the IPO price. Assuming a successful IPO at the midpoint of the proposed price range, the company's enterprise value at IPO (excluding underwriter options) would approximate $475.3 million. The float to outstanding shares ratio (excluding underwriter options) will be approximately 7.17%. A figure under 10% is generally considered a "low float" stock which can be subject to significant price volatility. Management says it will use the net proceeds from the IPO as follows: For investment in corporate infrastructure; For the construction of a data center for our AI technology and hiring approximately 23 software engineers;For increasing our engineering team to staff our planned AI technology data center; To market and host events such as live K-pop concerts; To develop services within the FANTOO ecosystem such as the fan shop, digital stickers, Augmented Reality filters, and emojis; and For general working capital purposes, operating expenses, and/or acquisitions of, or investments in, businesses, products, services or technologies. (Source - SEC) Management's presentation of the company roadshow is not available. Regarding outstanding legal proceedings, the firm is subject to an ongoing legal proceeding for debt assumed due to its purchase of Marine Island property. The sole listed bookrunner of the IPO is Aegis Capital Corp. Valuation Metrics For HanryuBelow is a table of the firm's relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options: Measure [TTM] Amount Market Capitalization at IPO $507,409,580 Enterprise Value $475,290,623 Price / Sales 570.74 EV / Revenue 534.61 EV / EBITDA -71.98 Earnings Per Share -$0.12 Operating Margin -742.74% Net Margin -718.36% Float To Outstanding Shares Ratio 7.17% Proposed IPO Midpoint Price per Share $10.00 Net Free Cash Flow -$4,112,158 Free Cash Flow Yield Per Share -0.81% CapEx Ratio -269.36 Revenue Growth Rate 85.13% (Glossary Of Terms) (Source - SEC) Commentary About Hanryu's IPOHRYU is seeking U.S. public capital market investment to fund its general corporate growth and working capital requirements. The firm's financials have produced increasing topline revenue from a tiny base, recent gross profit and positive gross margin, lowered but still high operating losses and reduced cash used in operations. Free cash flow for the twelve months ended December 31, 2022, was negative ($4.1 million). Marketing and Advertising expenses as a percentage of total revenue have dropped as revenue has increased from a tiny base. Its Marketing and Advertising efficiency multiple fell to 1.2x in the most recent period. The firm currently plans to pay no dividends and to retain any future earnings to reinvest back into the firm's growth and operating requirements. Hanryu has spent lightly on capital expenditures despite negative operating cash flow. Some industry observers estimate the market opportunity for fan-related websites to be $10 billion. Aegis Capital Corp. is the sole underwriter and the only IPO led by the firm over the last 12-month period has generated a return of negative (54.0%) since its IPO. This is a bottom-tier performance for all major underwriters during the period. Risks to the company's outlook as a public company include its tiny revenue base and limited operating history. Additionally, its growth potential rests on the demand for Korean culture throughout Asia. Should consumer attitudes about Korean culture change in a way that diminishes the appeal of the firm's services, it could be exposed to lower revenue growth potential. Furthermore, the Delaware-based holdings company operates subsidiaries in South Korea, all of which are subject to South Korean laws and regulations and may impact the ability to transfer profits, if any, to the parent company domiciled in the U.S. As for valuation expectations, management is asking IPO investors to pay an Enterprise Value / Revenue multiple of 535x trailing twelve-month revenue. Given the firm's tiny revenue base and excessive valuation assumptions, I'll pass on the IPO. Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research. Members of IPO Edge get the latest IPO research, news, and industry analysis. Get started with a free trial! |

【本文地址】